You Can Negotiate ANYTHING!

This weekend, one of my clients bought a new car…

I’m excited to share this because it’s a tough car buying market these days. Because of the chip shortage leading to a lack of inventory, it’s making buying a car really difficult.

The linked article gives some tips on what to do during this time, and the number one tip is to wait, even if it's painful…which is generally the advice I’ve given. However, for those of you who can’t wait like my clients, here's how the negotiations transpired...

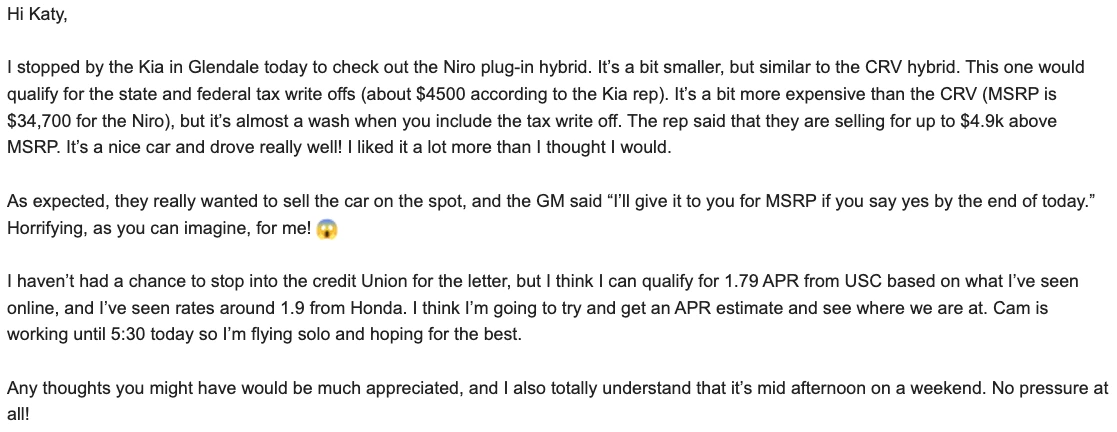

First, I got this email:

Besides asking my clients to pay MSRP (and saying that it's a "good deal" because the GM liked him), the dealership also offered 4.5-5.5% APR, which is super high!

At this point, we had a phone call because the dealership wanted my clients to just go ahead and buy the car at MSRP, taking a 4.5-5.5% APR and then going back to their credit union to refinance, which is not to their benefit at all because that’s just more time, energy and effort on their part. So, it’s a win for the dealership but not a win for them. So, I suggested to them:

1) Ask to take a couple of thousand off of the MSRP

or

2) Let’s wait until Monday or Tuesday when I can get the pre-approval letter from the credit union for the lower rate.

AND at this point, be willing to walk out of there (not in an angry way but in a nonchalant way like…it’s not that big-of-a-deal-to-us-kind-of-way).

After the call…here's the next text I got:

Here are the things I want you to take away from this blog post:

Even when inventory is short and car dealerships are selling at MSRP or sometimes higher (a bit shady, if you ask me)...everything is STILL NEGOTIABLE!

Start with negotiating the price of the car. Don’t tell them ahead of time what you want to pay monthly because that’s easily manipulated on the back end during the financing process. In my client’s case, the GM was selling the car to them at MSRP, which in a normal environment, isn’t very good because no one usually pays the sticker price. However because some dealerships are marking UP their cars, MSRP seems to be the bottom line these days. However…

Don’t let anyone pressure you to do something you’re not ready or don’t want to do. Period.

Get a pre-approval letter ahead of negotiating, so that you have a way to negotiate the financing. They WANT you to finance through them because that’s how they’re going to make more money from you. So, if you have a pre-approval letter from a credit union for less than what they’re offering, they will need to match or not get your financing.

Always be ready to walk away from a negotiation. The more desperate you are, the easier it is for you to get taken advantage of.

Take emotions out of any negotiations. You may fall in love with a car and want it so much that they can say anything and you’ll believe it. Instead, try to only buy a car when there’s another person who can be more level-headed, with you. Or call a negotiations expert, like me, to help! :)

What else do you want to know about negotiations? Please let me know in the comments. My good friend and fellow coach, Malika Amandi with the Center for Women’s Voices, and I are going to host a Negotiations Workshop in June. If you’re interested in getting more details, please let me know or sign up for the waitlist below.

With Gratitude,